‘Due to our low tax policy . . . revenue has increased.’

John James Cowperthwaite, Hong Kong Financial Secretary, 1961-71

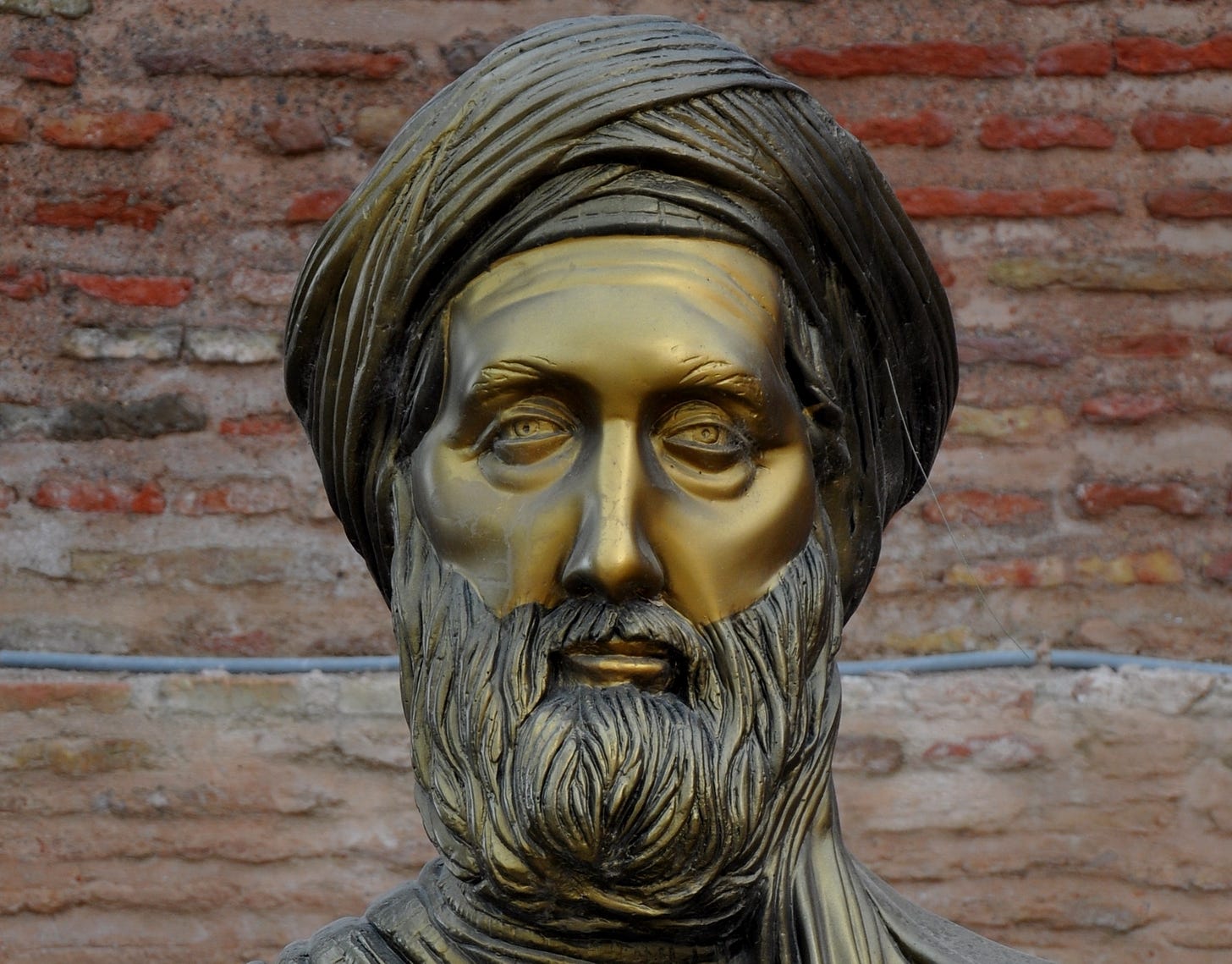

Fourteenth-century Tunisian, Ibn Khaldun, is probably the greatest philosopher of the Islamic Golden Age. In his magnum opus, The Muqaddimah, he wrote:

‘In the early stages of an empire, taxes are light in their incidence, but fetch in large revenue. As time passes and kings succeed each other, they lose their tribal habits in favour of more civilised ones. Their needs and exigencies grow . . . owing to the luxury in which they have been brought up. Hence they impose fresh taxes on their subjects . . . and sharply raise the rate of old taxes to increase their yield . . . But the effects on business of this rise in taxation make themselves felt. For businessmen are soon discouraged by the comparison of their profits with the burden of their taxes . . . Consequently, production falls off, and with it the yield of taxation.’

Never mind his own Islam, he might have been describing Rome or Greece before, or Britain or the US after. Low taxation and small government accompany the ascent of great civilisations, high taxation and big government their demise.

It may be counter-intuitive, but it is an observation that goes back centuries. Low tax rates often bring in greater revenue, while higher tax rates bring in less.

Khaldun was not the first to make this observation. It was the guiding philosophy of the fourth caliph, Ali. Take great care, he instructed his governors, ‘to ensure the prosperity of those who pay taxes. The proper upkeep of the land in cultivation is of greater importance than the collection of revenue for revenue cannot be derived unless the land is productive.’

If conditions are bad, then suspend taxes, he advised. “Do not mind the loss of revenue on that account, for that will return to you one day manifold in the hour of greater prosperity of the land and enable you to improve the condition of your towns and to raise the prestige of your state.”

Hong Kong’s John James Cowperthwaite acted by the same philosophy and would always push for the low- or no-tax option. Eventually, ‘funds left in the hands of the public will come into the Exchequer’, he said, but ‘with interest’.

In 1924, US Secretary of the Treasury Andrew Mellon wrote, ‘It seems difficult for some to understand that high rates of taxation do not necessarily mean large revenue to the government, and that more revenue may often be obtained by lower rates.’

But perhaps the most famous proponent of this argument was the American economist Arthur Laffer.

In 1974, Laffer was having dinner in Washington DC with two of (recently impeached) President Richard Nixon’s former advisers, Dick Cheney and Donald Rumsfeld, as well as a writer for the Wall Street Journal by the name of Jude Wanniski. Laffer was arguing that the incumbent president Gerald Ford’s recent tax increases were flawed and would not lead to increased government revenue.

To illustrate his argument, so the story goes, he drew a curve on a napkin showing the relationship between tax rates and revenue. At very low rates of tax, government revenue is low; but it is also low at high rates (because the economy is weaker, profits are down, earnings are down, evasion is higher and so on), so the curve is bell-shaped.

The top of the bell is the point of maximum revenue – that is, the sweet spot at which to place tax rates if your goal is to maximise government revenue. Laffer’s argument caught the imagination of those present; Wanniski would later dub it ‘the Laffer Curve’, even though Laffer later stressed, ‘The Laffer Curve, by the way, was not invented by me,’ and mentioned many others, from Keynes to Khaldun, who had observed the same phenomenon (perhaps we should call it the Fourth Caliph Curve).

As President J. F. Kennedy once said, ‘It is a paradoxical truth that tax rates are too high today and tax revenues are too low, and the soundest way to raise the revenues in the long run is to cut the tax rates.’

It is a lesson that mankind continually seems to forget, and one that continually needs re-teaching. Hence today’s post.

(That was an adapted extract from Daylight Robbery, How Tax Shaped our Past and Will Change our Future).

The lesson leaders never learn: high taxes do not mean greater revenue